Participa y gana un boleto doble

Acepta tu oferta de Crédito Personal, regístrate en Citibanamex Móvil, responde correctamente la trivia ¡y conviértete en uno de los ganadores! Conoce más

Vigencia del 5 de junio al 5 de agosto de 2023.

Te acompaña toda la vida

porque es redisponible(1)

cuando lo pagas lo puedes reusar

Tasas atractivas: Tasas fijas durante toda la vida de tu crédito(2)

Es conveniente, ya que lo puedes contratar y redisponer tanto en sucursal como en canales digitales

Seguro de liberación

de adeudo por

fallecimiento sin costo(3)

Conoce las características del

Crédito de Nómina Citibanamex

Obtén un monto de

hasta

$500,000(4)

Contamos con múltiples plazos,

de 12 a 72 meses(5)

Tasa de interés anual fija

desde el 16%(2)

Contrata tu crédito en

Citibanamex Móvil,

BancaNet,

o Cajeros Automáticos

¿Qué necesito para solicitar mi Crédito de

Nómina Citibanamex?

¿Qué necesito para solicitar mi Crédito de

Nómina Citibanamex?

Recibir tu nómina

en Citibanamex.(6)

Tener entre 21 y 79 años

de edad.(7)

Comprobante de domicilio, no

mayor a 3 meses.

Si tu domicilio es distinto al de tu INE/IFE,

puedes presentar: Recibo de luz, agua, telefonía

fija, predial, tv de paga o estado de cuenta.(8)

Tener un ingreso mínimo de $1,800 pesos.(9)

Identificación oficial vigente o

tarjeta de residencia temporal y permanente.(10)

Tener al menos 3 meses de antigüedad con tu nómina en Citibanamex.

Tener teléfono móvil o de domicilio actualizado.

Acepta la oferta en línea

Solicita tu crédito a través de

Citibanamex

Móvil,

BancaNet,

Cajeros Automáticos o

localiza tu

sucursal

más cercana.

Entrega tus documentos y conoce las condiciones

Presenta identificación oficial y comprobante de domicilio vigentes.

Recibe tu Crédito de Nómina

Confirma los datos y recibe tu Crédito de Nómina.

Participa y gana un boleto doble

Acepta tu oferta de Crédito Personal, regístrate en Citibanamex Móvil, responde correctamente la trivia ¡y conviértete en uno de los ganadores! Conoce más

Vigencia del 5 de junio al 5 de agosto de 2023.

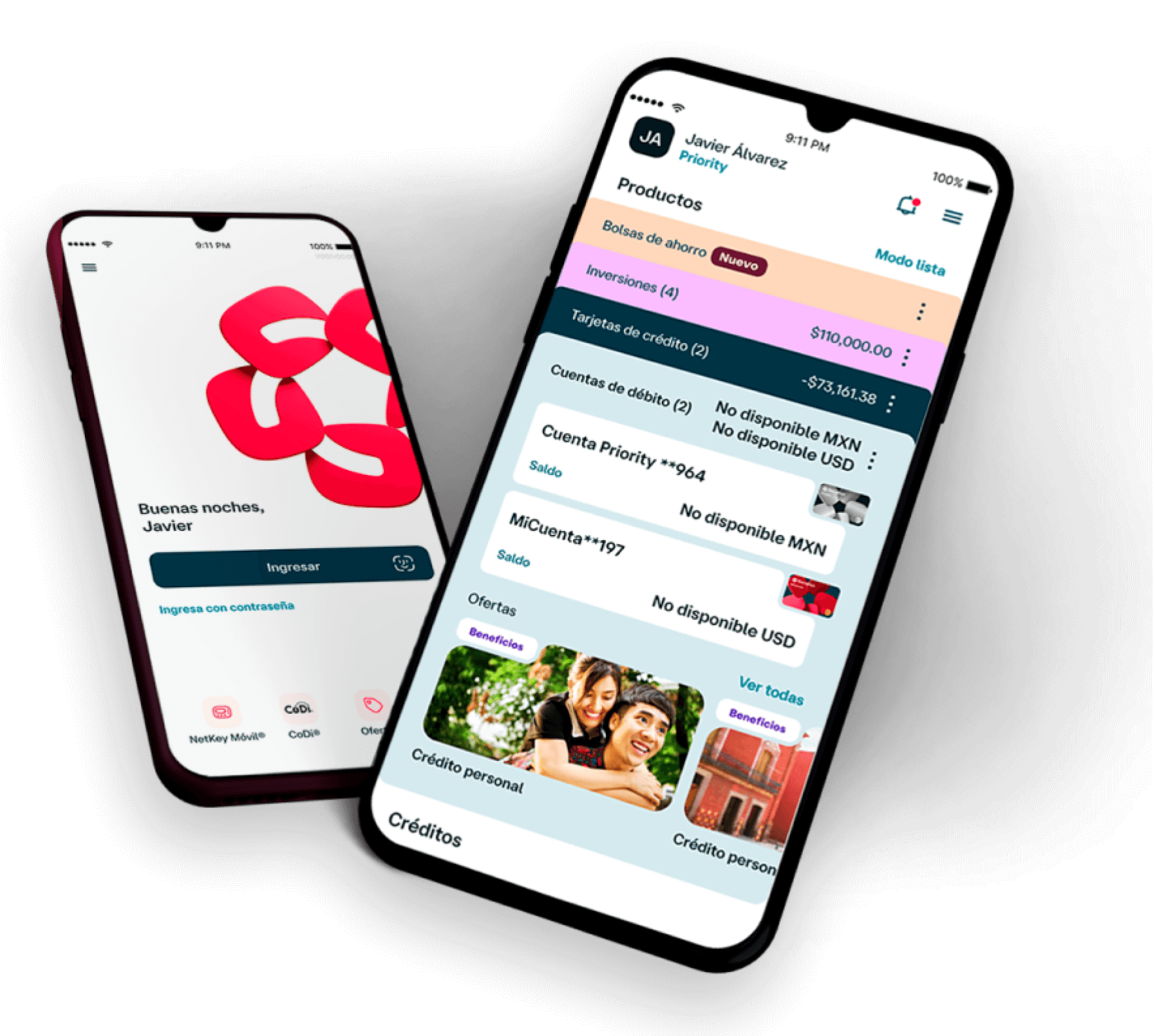

Revisa tus ofertas desde tu celular

App Citibanamex Móvil

Contrata tu Crédito de Nómina Citibanamex y realiza tus pagos

Compra en línea más seguro con CVV Digital

¿Perdiste tu tarjeta? Bloquéala sin ir a sucursal

Descubre más productos

que podrían interesarte

Tarjetas de Crédito Citibanamex

Solicita tu tarjeta y recíbela en casa.

Quiero mi tarjeta

Cambia tu Hipoteca más Liquidez

Trae tu crédito hipotecario con nosotros y obtén efectivo para lograr tus metas.

Conoce más

Crédito Personal

Despreocúpate y úsalo para imprevistos o inversiones, tú decides.

Conoce más

Tenemos dos tipos de modalidad, una que cuenta con redisponibilidad: conforme vas pagando puedes volver a utilizar la línea de crédito disponible sin trámites adicionales, tus pagos periódicos se determinan conforme a un plazo para su cálculo, de redisponer se inicia nuevamente tu contador de pagos; y otra modalidad, sin redisposición: es decir, crédito simple, con plazo fijo de vencimiento y ambos con tasa de interés anual fija.

Sí, debes recibir el pago de nómina o pensión en tu Tarjeta de Débito Citibanamex.

Es muy rápido, si recibiste una invitación te daremos respuesta en 30 minutos o máximo 48 horas hábiles. Si es una solicitud sin invitación, podría tardar hasta 5 días hábiles.

Revisa si recibiste una invitación a través de tu aplicación móvil, BancaNet, Cajeros Automáticos Citibanamex o por correspondencia, en caso contrario, consúltalo a través de cualquier Sucursal Citibanamex.

Puedes pagar tu crédito a través de Citibanamex Móvil, BancaNet o en cualquiera de nuestras Sucursales Citibanamex.

Comunícate desde cualquier

parte del país al:

55 1226

2639

Horario de atención telefónica de lunes a domingo las 24 horas del día.

Siéntete seguro, previniendo imprevistos con nuestros Seguros Citibanamex. Conoce las opciones que tenemos para ti como: seguro de auto, seguro de vida, seguro de hospitalización, seguro de casa, seguro PYME, seguro de viaje, seguro de accidentes, seguro de bolso protegido y seguro de compras protegidas

Conoce nuestras Tarjetas de Crédito Citibanamex o cuentas de débito y elige la que mejor se adapte a tus necesidades. Además aprovecha las Preventas Citibanamex, nuestras promociones, los beneficios en viajes y nuestra banca digital para hacer tu vida más cómoda.

Recibe apoyo financiero y cumple tus metas con nuestras opciones en crédito de nómina, crédito personal, crédito hipotecario y fondos de inversión.

Si aún no eres cliente Citibanamex, cambia tu nómina y aprovecha grandes beneficios al realizar tu portabilidad de nómina.

CAT PROMEDIO

Sin IVA. Calculado el y vigente al . Tasa de interés anual fija .

* Obtén tu aprobación en tan solo 30 minutos pero puede variar hasta 48 horas hábiles.

(1) Crédito redisponible, mientras lo vas pagando lo puedes volver a utilizar. Por ejemplo, si tienes una línea de crédito de $10,000 y pagaste ya $5,000, estos los puedes volver a pedir y utilizar.

(2) La tasa de interés será asignada al cliente de acuerdo a tu perfil crediticio. La tasa de interés anual fija máxima del crédito es del 49.00% más IVA y la tasa de interés anual fija para pensionados del IMSS es 25.00% promocional y tiene una vigencia del 31 de enero de 2024 al 31 de julio de 2024.

(3) En caso de fallecimiento, cuentas con un seguro de liberación de adeudo, siempre que te encuentres al corriente en tus pagos. Aplican los términos y condiciones del contrato.

(4) Para Crédito Nómina Citibanamex (CNC) puedes obtener desde $2,000 hasta $350,000 según tu capacidad de pago, sin referencias crediticias. O bien, si cuentas con referencias, te ofrece desde $2,000 hasta $500,000.

(5) Para Crédito Nómina Citibanamex (CNC) los plazos son 12, 18, 24, 36, 48, 60 y 72 meses con Frecuencia de pago quincenal y mensual. Si realizas una nueva disposición, se calcula nuevamente el saldo insoluto conforme el plazo originalmente contratado.

(6) Recibir tu nómina en Citibanamex en MiCuenta o Cuenta Priority.

(7) Cliente Pensionado 40 a 79 años 11 meses. Cliente No Pensionado: 21 a 79 años 11 meses.

(8) En todos los casos, es requisito presentar comprobante de domicilio en caso de que el domicilio sea distinto al que se contiene en el INE. Recibo de Luz, recibo de gas natural, recibo de agua, recibo de TV por cable, estado de cuenta bancario (Debe estar a nombre del solicitante), emitidos dentro de los 90 días al momento de hacer el trámite.

(9) Ingresos mensuales mínimos de $1,800 si eres empleado o de $1,000 si eres pensionado.

(10) Solicítalo en Sucursal. Para nacionales: presentando una identificación oficial: INE / Credencial de Elector vigente. Si el cliente tuviese algún impedimento físico que limite poder obtener sus huellas digitales deberá presentar Pasaporte + INE. Para extranjeros: Pasaporte + tarjeta de residente temporal y permanente o forma migratoria siempre y cuando estén vigentes.

Datos de contacto de la UNE (Unidad Especializada de atención a usuarios) y Centro de Atención de Citibanamex: Av. Insurgentes Sur No. 926, Colonia del Valle, Delegación Benito Juárez, C.P. 03100, Ciudad de México, teléfono: 55 1226 4583, mail: une@citibanamex.com, teléfono del Centro de Atención Telefónica: 55 1226 2639..

Descripción: Crédito redisponible en moneda nacional, ofrecido en toda la República Mexicana por Banco Nacional de México S.A., integrante del Grupo Financiero Banamex y dirigido a persona física residente en México

Recomendaciones: Incumplir tus obligaciones te puede generar comisiones e intereses moratorios. Contratar créditos que excedan tu capacidad de pago afecta tu historial crediticio.

"En caso de que el pago de mensualidades se haga mediante el servicio de cargo automático a su cuenta de cheques, deberá contar con disponibilidad de fondos en la fechas de pago para el buen manejo de su crédito y evitar el pago de intereses moratorios. Le recordamos que en cualquier momento puede solicitar la cancelación de dicha domiciliación sin costo, en cuyo caso deberá acudir a realizar los pagos acudiendo directamente a sucursal, en BancaNet o Citibanamex Móvil.”

Portabilidad de Nómina: Si tu patrón determina el cambio de banco para la dispersión de tu nómina o pensión, tienes derecho a mantener tu cuenta en Citibanamex y solicitar al banco donde tu patrón realice la dispersión de tu nómina o pensión, que transfiera sin costo la totalidad de dichos recursos a tu cuenta Citibanamex. En cualquier caso, deberás continuar realizando los pagos de tu crédito nómina ya sea mediante cargo a tu cuenta en Citibanamex, realizando el pago directamente en sucursales Citibanamex, Citibanamex Móvil o BancaNet.

Subir